Taking back dentistry from COVID-19 impact, a State level analysis.

Sikka Software is the leading provider of award winning API platform and marketplace of applications to the dental industry, and over the last several weeks we have been tracking over 10,000 opt-in dental practices to measure the impact of the Coronavirus pandemic on the industry. We have been focusing on production, visits and functional areas such as orthodontics, oral surgery, preventative and restorative procedures, endodontics and periodontics procedures, implants and prosthodontics procedures and more.

As you may know, due to shelter in place directives in many states, dental offices were shuttered in most of the country starting in March (except for emergency procedures) and they just started reopening over the last few weeks. We created a map that tracked the economic impact of COVID-19 on dentists, veterinarians and other retail healthcare practices on a state-by-state basis.

We’ve found that some states are rebounding faster than others. For example, in several states — including North Dakota, Wisconsin, Hawaii and Utah — dental production is actually higher than it was before COVID-19 hit, as people who deferred procedures have been coming back quickly. This bodes well for our overall economy, as there has been a lot of debate over whether it will be an L — or U — or V -shaped recovery.

According World Economic Forum and VisualCapitalist, dental healthcare is one of the highest COVID-19 risk businesses. ADA Guidelines published on April 1, 2020 identified the potential risk of dental practitioners getting the virus due to the nature of their work including aerosolized particles. If offices are opening — with very specific procedures and PPE to minimize exposure — it indicates that other businesses can manage the transmission risk of COVID-19 if they implement appropriate protocols.

Data and insights that Sikka Software provides are useful for:

A) manufacturers and their sales force planning, marketing and resource allocations,

B) financial services companies who are interested in investment allocation and planning,

C) Q2 and Q3 financial performance and earnings,

D) dental offices human resources and PPE equipment planning

E) dental organizations which are planning education, webinars and awareness to their membership base.

When will my State fully recover?

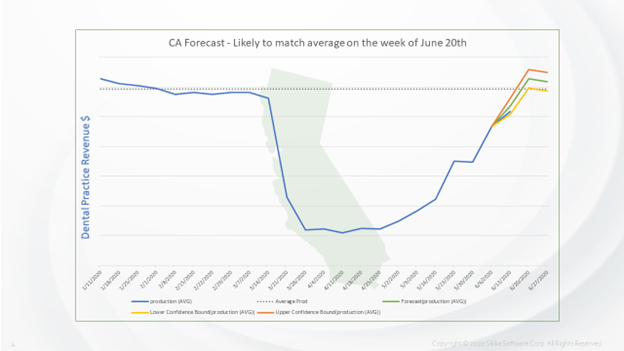

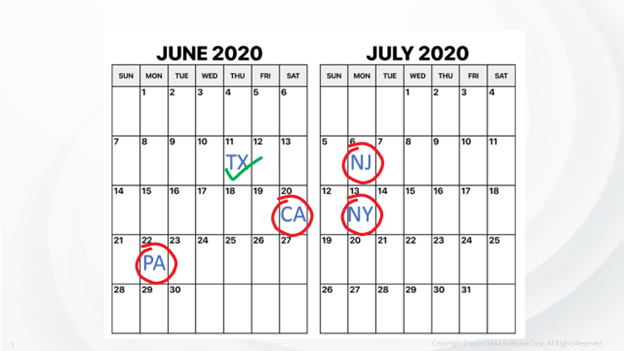

We applied predictive models to all the data that we are seeing and have attempted to identify a few States that have just opened and project when they will reach their pre-Covid averages. Examples of States that opened earlier and have already reached pre-Covid levels (or in many cases exceeded them) are Texas, Kansas, and Ohio. While California has slowed down recently as illustrated by the below chart, our prediction indicates California will reach pre-Covid in the next week or so.

New York on the other hand will reach their pre-Covid averages in the week of July 13th. And New Jersey will do the same in the week of July 6.

Pennsylvania will reach pre-COVID-19 numbers in the last week of June.

We believe dental practices will emerge stronger with better infection control methods and utilization of modern technologies for patient communication, frictionless payments and tele-dentistry. Below is an interesting chart that compares COVID — 19 economic crisis to the Great Recession of 2008. Note this is from dental practices production and in general the dental practice industry emerged from 2008 recession relatively unscathed. From 2008 to 2020 dental production grew by over 40% and other than a small deceleration in growth there was no impact from the 2008 financial crisis. The 2020 COVID-19 economic crisis caused dental production to fall by 85%, but the rise as States have reopened has been equally dramatic.

At its core, our company is focused on optimizing the business of healthcare with connectivity, applications and insights. Many retail healthcare practitioners are owner/operators and have a lot to worry about in managing their patients, practice, and their operating costs. Our goal is to make it easier for them to run their business by providing information, software and services to manage their patients’ care so they can focus on providing the best care possible for them. We have been in business for 16 years, and our mission is to be the platform that transforms global retail healthcare.

We do that by providing an easy way for application developers to connect to retail healthcare practices and deliver innovative new applications. We have over 50 partners developing practices for the Sikka marketplace, along with over 35,000 retail healthcare practices serving over 120 million patients using these applications to modernize how they run their practices and support their patients — both human and pet. Feel free to direct message or email me at vijay.sikka@sikkasoftware.com to learn more. You can visit https://www.sikkasoft.com/covid-19-rebound.html to get the latest data

This press release was originally published June 22, 2020. View the original article here.